Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

For years, the Rule of 40 has been a cornerstone metric in the SaaS industry. It's a simple yet powerful guideline for assessing whether a company is balancing growth and profitability effectively. However, as markets evolve and new priorities emerge, alternative metrics such as the Rule of X are challenging traditional thinking, prompting SaaS leaders to rethink how they measure success.

In this post, we’ll explore the origins and significance of the Rule of 40, discuss its relevance in today’s SaaS landscape, delve into the Rule of X as a fresh perspective, and highlight ongoing industry debates as reflected in recent LinkedIn discussions and polls.

The Rule of 40: A SaaS Benchmark

The Rule of 40 is a financial metric designed to evaluate the health of SaaS companies. At its core, it states that a company’s combined revenue growth rate and profit margin should equal or exceed 40%. For example:

- A company growing revenue by 30% with a profit margin of 10% would meet the Rule of 40.

- Similarly, a slower-growing company with 15% revenue growth but a 25% profit margin would also satisfy the rule.

This metric became widely accepted because it offers a balance between two key drivers of business performance—growth and profitability. SaaS companies often face a trade-off: should they reinvest heavily in growth, potentially sacrificing profits, or focus on profitability at the expense of rapid expansion? The Rule of 40 provides a framework to strike that balance.

Why It Matters

The Rule of 40 is particularly useful for investors and stakeholders who need to quickly assess a SaaS company’s financial health. It serves as a shorthand for determining whether a company is on a sustainable trajectory. High-growth SaaS businesses can often run at significant losses for years. However, if they meet the Rule of 40, it signals that their growth outweighs their lack of profitability.

Companies that fall short of the Rule of 40, on the other hand, may face challenges in securing funding, maintaining investor confidence, or generating cash flow. For this reason, the Rule of 40 has become a North Star for SaaS executives aiming to scale sustainably.

Limitations of the Rule of 40

While the Rule of 40 has proven useful, it’s not without its critics. One common critique is that it treats growth and profitability equally, which may not always align with the realities of SaaS businesses. For example:

- In the early stages, SaaS companies often prioritize growth over profitability, reinvesting heavily in customer acquisition, product development, and market expansion.

- Conversely, mature SaaS companies may focus more on profitability, especially if they’re operating in saturated markets with limited growth opportunities.

Additionally, the Rule of 40 doesn’t account for varying growth rates across industries or market conditions. In a booming market, a growth rate of 20% may seem lackluster, while in a recession, the same growth rate might be impressive.

This one-size-fits-all approach has led some industry leaders to call for more nuanced metrics.

The Rule of X: A New Perspective

Bessemer Venture Partners recently introduced an alternative metric known as the Rule of X. This new framework acknowledges that growth is often more valuable than profitability, particularly for high-potential SaaS companies.

How It Works

The Rule of X modifies the traditional Rule of 40 by assigning a multiplier to growth, reflecting its greater weight in SaaS valuations. The formula typically looks like this:

(Growth Rate × Multiplier) + Free Cash Flow Margin = X

For private companies, the multiplier is often set at 2x. For public companies, it may range from 2x to 3x. For instance:

- A private SaaS company with a growth rate of 25% and a free cash flow margin of 10% would calculate its Rule of X as follows: (25 × 2) + 10 = 60.

- This score of 60 exceeds the Rule of 40 threshold, signaling strong performance.

Why the Rule of X Matters

The Rule of X recognizes the compounding nature of growth. A company growing revenue at 30% annually can double its size in about three years, which has a significant impact on valuation. By placing more emphasis on growth, the Rule of X aligns better with investor expectations in growth-oriented markets.

Moreover, the Rule of X is flexible enough to adapt to different stages of a company’s lifecycle. For early-stage companies, growth is paramount. For later-stage companies, profitability becomes more important. By adjusting the multiplier or focusing on different components of the equation, the Rule of X can reflect these shifting priorities.

Industry Perspectives: The LinkedIn Debate

The relevance of these metrics sparked a lively discussion on LinkedIn, led by Dirk Sahlmer, a SaaS industry expert. In his post, Sahlmer highlighted the enduring importance of the Rule of 40 while acknowledging the need for nuanced approaches like the Rule of X.

The Case for the Rule of 40

Many professionals argue that the Rule of 40 remains a valuable benchmark, particularly for companies seeking stability. It provides a clear, objective standard that’s easy to communicate to investors and stakeholders.

In tighter markets, where access to capital is constrained, profitability often takes precedence over growth. For these companies, the Rule of 40 serves as a reminder to maintain financial discipline and avoid overextending.

The Shift Toward Growth

Others in the discussion emphasized the importance of prioritizing growth, especially for high-potential startups. As one participant noted, “Growth creates optionality. Profitability can come later, but you can’t go back and recapture lost growth opportunities.”

This sentiment aligns closely with the principles behind the Rule of X, which values growth at two to three times the rate of profitability.

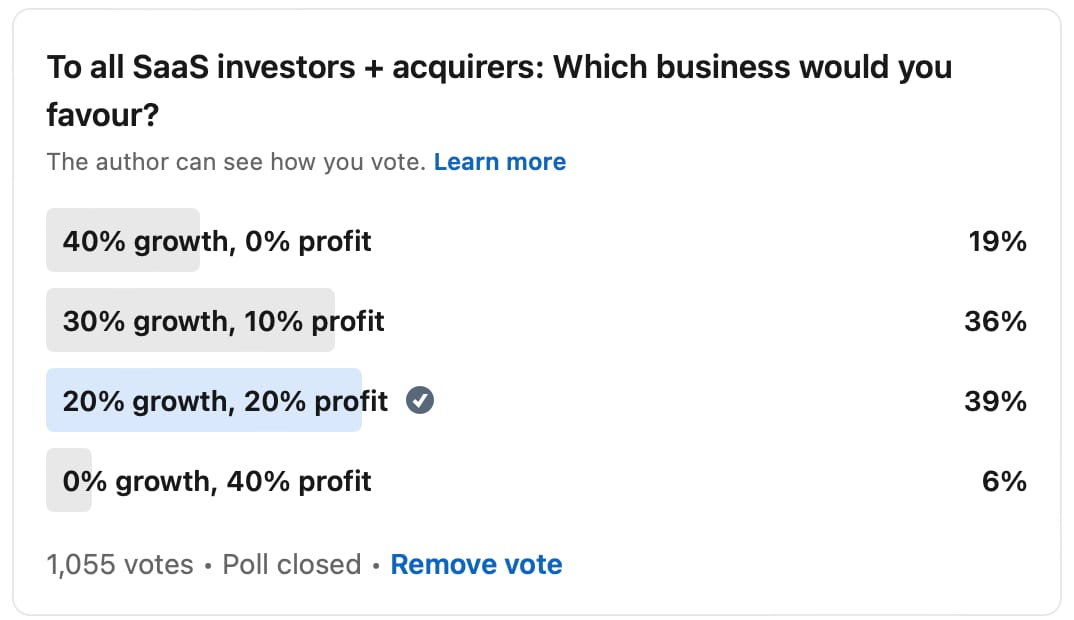

A Community Poll: Growth vs. Profitability

Sahlmer also conducted a LinkedIn poll asking SaaS professionals to weigh in on the perennial debate: growth vs. profitability. The results revealed a diversity of opinions:

- Some respondents leaned heavily toward growth, citing its long-term impact on valuation and market positioning.

- Others advocated for profitability, particularly in today’s uncertain economic climate, where cash flow and sustainability are critical.

The poll underscores the fact that there’s no one-size-fits-all answer. The right balance depends on factors such as a company’s stage, market conditions, and strategic goals.

Which Metric Should SaaS Companies Use?

Both the Rule of 40 and the Rule of X offer valuable insights, but they’re not interchangeable. Here’s how SaaS companies can decide which metric to prioritize:

1. Early-Stage Companies: Focus on growth. The Rule of X is more applicable, as it reflects the outsized importance of revenue expansion at this stage.

2. Mature Companies: Balance growth and profitability. The Rule of 40 provides a more holistic view, ensuring that neither metric is neglected.

3. Market Conditions: In booming markets, growth may take precedence. In tighter markets, profitability and cash flow become more critical.

Ultimately, the key is to align metrics with the company’s strategic priorities and communicate them effectively to stakeholders.

The Rule of 40 has long been a trusted guideline for SaaS companies, offering a clear framework for balancing growth and profitability. However, as the industry evolves, metrics like the Rule of X provide fresh perspectives that better reflect the nuances of SaaS performance.

Whether you’re a founder, investor, or executive, understanding these metrics—and the debates surrounding them—can help you make more informed decisions. As the LinkedIn discussions and poll reveal, there’s no single right answer. The best metric is the one that aligns with your company’s unique goals and circumstances.

By staying flexible and open to new ideas, SaaS leaders can navigate the challenges of growth and profitability, ensuring long-term success in an ever-changing landscape.